working two jobs at the same time tax

Week1 pay 250 tax allowance 212 38 taxable 760 tax deducted. More Network and Job Opportunities.

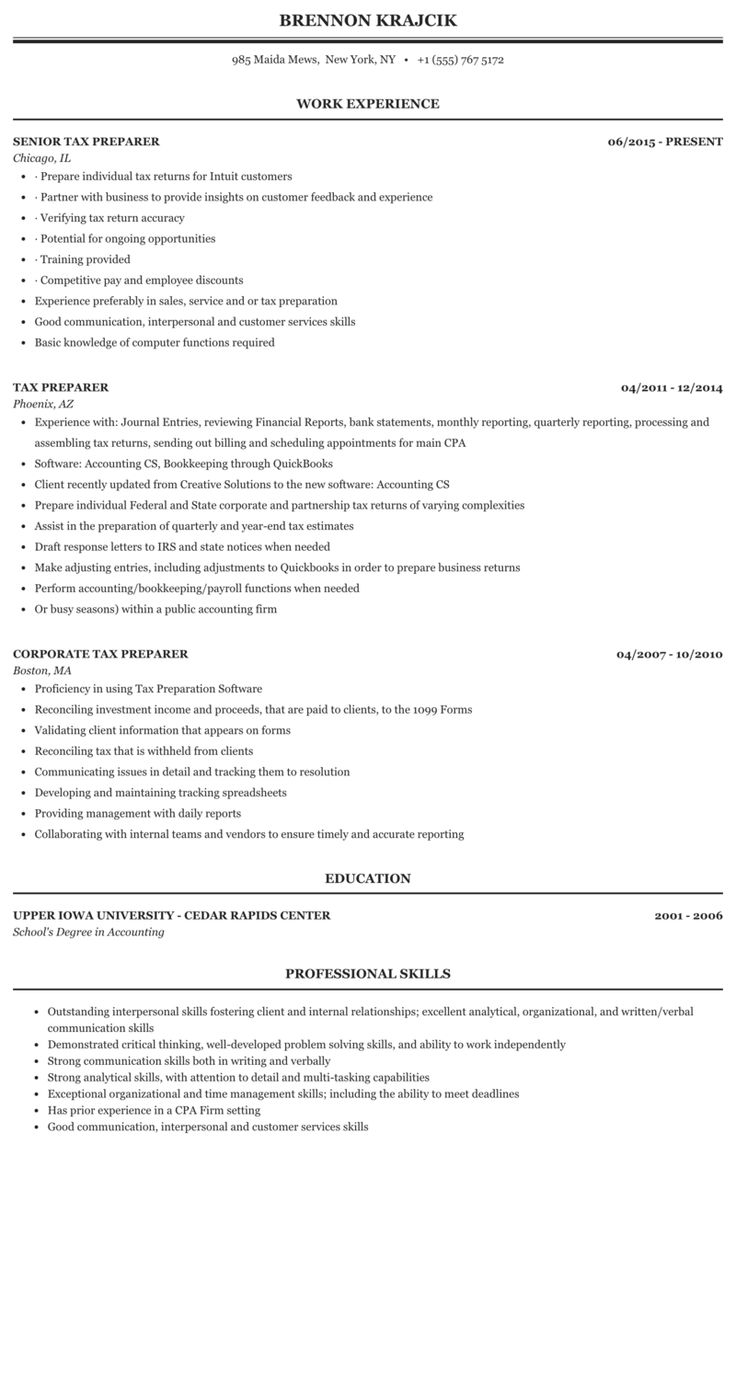

4 Cv Templates Used By Harvard And Mckinsey And The Danish Job Market

Test a New Job Without Quitting the Other One.

. These common connections are not what you think. Meanwhile the full 600 from your second job is taxed at 20 or 12000 leaving you with a bill of 15050. Income Tax on second jobs.

To avoid potential conflicts of interest time or logistics manage your time. You only get one Personal Allowance so its usually best to have it applied to the job paying you the most. Income Tax on a second job would mean you pay 40 on anything over 50271 or 45 on earnings beyond the 150000 mark.

Nothing is certain except for death and taxes Benjamin Franklin 1 Surprise Taxes with Multiple Jobs. The way you work out their PAYE tax wont change. No tax due as the 2 months pay are less than the tax allowance but 760 has already been.

If youre fortunate enough to be in that position it can be tempting to consider working two cleared jobs even two full-time cleared jobs simultaneously to stockpile cash payoff debt or retire early. So you switched jobs. If you work in full-time employment but earn money freelancing on the side you can use the same method above to work out your taxable income.

Hence both the companies can extend you the benefits of PF but on the same PF account. In such case there cannot be two registrations that can be done. However if your second job takes you into a higher tax bracket then you will pay the higher rate on the amount of income that is in the next bracket.

Second if the two businesses are in the same field or if somehow working in both at the same time were to constitute some kind of conflict of interest you could have a problem. You work two jobs where your first job pays 9000 and your second job pays 3000. No tax will be paid on the first position as it is under your personal allowance but the second job will be taxed at 20.

However if your first position falls below your personal allowance your second job tax will generally be set at the standard 20. We combed through several situations where employees got caught working two jobs. Gig workers are part of a flexible and on-demand workforce who do multiple short-term jobs gigs and can be anyone from part-timers looking to make extra.

Weve seen plenty of clearance-holders do that over the years including those who worked predominantly from home and one. From claiming expenses to paying tax and ACC levies heres what you need to know if youre a freelancer or contractor working in temporary jobs. The goal is to be as close as possible to the amount actually withheld and the amount you actually owe in taxes at the end of the year.

Last week the Wall Street Journal reported on a. Secondly to claim the benefits of PF contribution with two or more companies you will have to share the same UAN number with the other company also where in they can record the contribution. It also gives you.

Individuals who have more than one employer. Your payroll tax deductions are determined by the TD1 forms both federal and provincialterritorial that you fill out for the employer when you are hired. When you work a PAYE job and a freelance job paying National Insurance works kind of similarly to the way you pay tax.

You do not need to complete the Two EarnersMultiple Jobs Worksheet Advertisement. Paying National Insurance when you have a side job. This will result in having to write a much smaller check to the IRS when you to file your next tax return.

Earnings from both jobs combined are under your personal allowance and so none of your earnings should be subject to income tax. Youll Have Excess Social Security Tax. Having a second job doesnt just give you more money.

Lets look at some examples. If youre working youre entitled to earn a certain amount of money without paying Income Tax. This is called the Personal Allowance and is 12570 for the 202223 tax year.

250 150 400 tax allowance 212 212 424. If your employee thinks theyll earn more than 41865 they can apply to delay paying. The bigger your network the more opportunities you have.

If youre serious about juggling two full-time jobs this means you cant phone it. You work two jobs where your first job pays 9000 and your second jobs also pays 9000. The tax rates are exactly the same as they are on your main income so you do not pay more in tax if you have a second job.

It might not be illegal to work two jobs provided you have the time and can separate the two but the ability to engage in moonlighting activities or gigging or simply balancing the time necessary for two full-time jobs can present a challenge. They are not always the employers or HR finding out but rather friends co-workers daycare parents clients or some. Your guide to working multiple jobs.

The common theme is these less-sly employees were caught through unforeseen shared connections. If you work one job at a time then the only thing you might want to consider is if you should have more taxes withheld if you get a significant raise at the new job. On the other hand a secondary income can tip you over into the higher or additional-rate earning group.

If you are paid 150 per week in your first job and 100 per week in your second job. More Than One Job at a Time as an Employee. Week 2 pay 150.

In so many words you really dont want to get caught. If you are working at 2 or more jobs in the same month and this continues throughout the year you may owe income taxes at the end of the year. Around 50 of the respondents to the survey said that theyve worked for another company while on the clock with their employer.

The IRS and tax regulations still operate in a one-employer-for-one-employee world and hence why youll encounter some tax surprises while working two high-paying jobs at the same time. It would be a violation of your duty of loyalty to one employer to somehow divert work away from that employer for the benefit of the other employer. Skip to the Employees Withholding Allowance Certificate section of page 1 of the W-4 form if the total in line H of the Personal Allowances Worksheet section is zero.

Who knows one of your co-workers or bosses might refer you to your dream job. When it comes time to file your taxes you will have W2s from multiple jobs but you only worked one at a time.

Full Time Working Moms Are Not Part Time Moms They Just Actually Have Two Full Time Jobs Mo Riginal 5 0 Working Mom Quotes Working Mom Humor Funny Mom Quotes

6 Tips For Filing Taxes With Multiple Jobs Filing Taxes Finance Saving Extra Jobs

Nomisma The Finest Software For Income Tax Computation Accounting Jobs Pinterest For Business Payroll Accounting

Cool Cool Credit Analyst Resume Example From Professional Check More At Http Snefci Org Cool Credit Analyst Resume Example Professional

Cover Letter For Finance Job Position Job Cover Letter Finance Jobs Cover Letter Template

43 Resume Tax Accountant Images Tax Accountant Accounting Jobs Resume

An Audit Resume Is Quite Important To Learn As You Are About To Apply For Job To Be An Auditor Here You Do Not Need To Be Worried Since You Can Just

Pin On Business Management Ideas

Today Marks Exactly Two Years Since I Quit My Full Time Job To Become Self Employed Exactly Two Years Ago Work From Home Tips Work From Home Business I Quit

Working From Home With Toddlers Here S How To Easily Do It The Wary Worker Working From Home Work From Home Tips Work From Home Moms

Graduate Cover Letter How To Draft A Graduate Cover Letter Download This Graduate Cover Le Cover Letter Template Lettering Download Application Cover Letter

Pin By Linda Ghazi On Education Cover Letter For Internship Writing A Cover Letter Introduction Letter For Job

Driving An Uber Has Been All Fun And Games Up Until Tax Time Tax App Tax Time Tax Guide